Move to Monmouth County: Your Guide to Homes and Lifestyle

Thinking about buying a home in Monmouth County, NJ? With its shoreline charm, suburban comfort, and endless activities, Monmouth County offers something for everyone. Whether you’re drawn to coastal living, small-town charm, or easy access to New York City, Monmouth County seamlessly blends it all.

-

For starters, its scenic beaches, vibrant downtowns, and family-friendly neighborhoods make it an ideal place to live or visit.

-

Sandy Hook, Asbury Park, Long Branch, and Belmar are perfect for swimming, sunbathing, or just relaxing with a view.

2. Outdoor Recreation and Hiking

-

Hartshorne Woods Park, Thompson Park, and Huber Woods offer scenic trails and plenty of wildlife.

-

Monmouth County parks are perfect for walks, hikes, or family outings.

3. History and Culture

- Explore local history at the Monmouth County Historical Association, Twin Lights Lighthouse, and Allaire Village.

-

Enjoy the arts at the Count Basie Center for the Arts, Two River Theater, and Monmouth Museum.

4. Shopping, Dining, and Entertainment

-

Shop at Jersey Shore Premium Outlets, Monmouth Mall, or downtown Red Bank.

-

Discover a variety of restaurants, cafés, and boutique shops for every taste.

5. Festivals and Events

-

Attend the Monmouth County Fair, Asbury Park Oysterfest, or Red Bank Food and Wine Walk.

-

These events bring food, music, and entertainment for everyone to enjoy.

-

7. Take the Next Step

-

Whether you are buying, selling, or just exploring, Monmouth County offers a lifestyle worth experiencing.

-

Reach out today to start your next move with confidence. Click here for your next home.

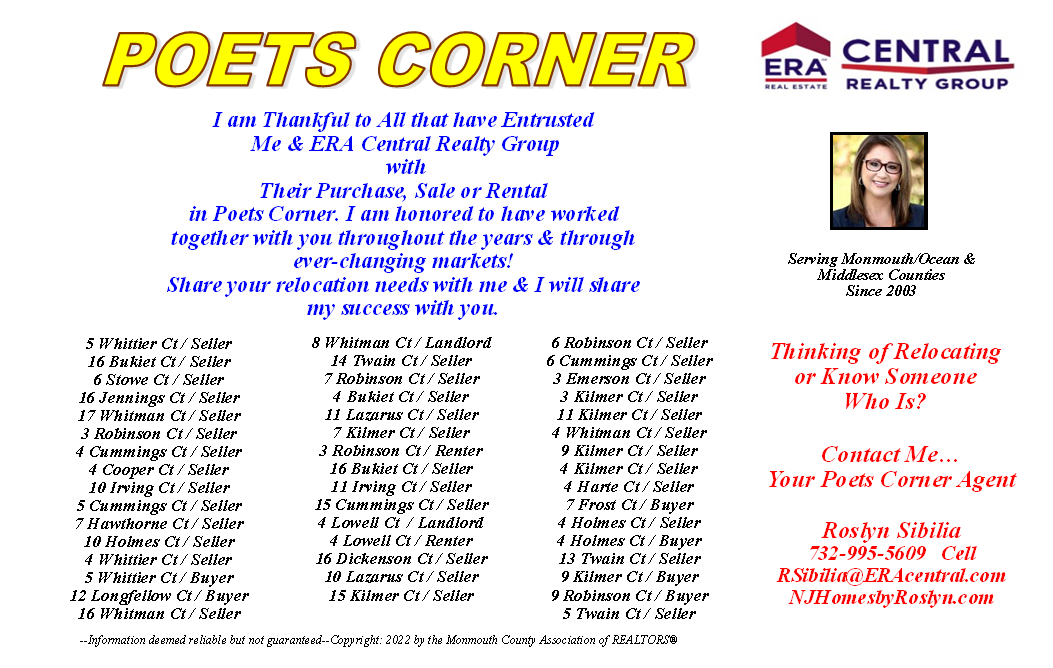

Roslyn Sibilia, Realtor® | 732-995-5609 | RSibilia@ERAcentral.com | NJHomesbyRoslyn.com

📲 #REsultsWithRoslyn | #SuccessWithSibilia | #SibiliaSellsNJ |

🔑 Roslyn Sibilia, Realtor with Proven Results in Monmouth, Ocean and Middlesex Counties Since 2003

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link