First time home buyers leaping ahead… and I am ready to help you through the process…First time home buyers are proving to take advantage of the current interest rates, which have been around 3%. it’s a great time to buy if you are renting and paying your landlord’s mortgage. For the same rental amount and possibly less you can purchase the security of being able to live in your home as long as you so choose.

Here’s an article by Realtor.com and about First Time Home Buyers

July 23, 2020By: Scholastica (Gay) Cororaton

First-time buyers accounted for 35% of existing homes sold in June 2020, according to the latest Realtors® Confidence Index (RCI) Survey report, a report based on a monthly survey of Realtors® about their transactions during the month.1 The share of first-time buyers increased in March through June—right into the heart of the pandemic period and the surge in unemployment—and is now trending higher than the 29% to 32% average in past years since 2012.

Why the rise in home buying? The major factor is, arguably, low mortgage rates. As of the week ended July 16, the 30-year fixed mortgage rate dropped to 2.98%. With rates so low that are locked in under a 30-year mortgage, the typical mortgage payment, estimated at $1,036, has fallen below the median rent, at $1,045. For potential home buyers who were thinking of purchasing a home anyway before the pandemic outbreak and who are likely to remain employed, the low mortgage rate may be the clincher.

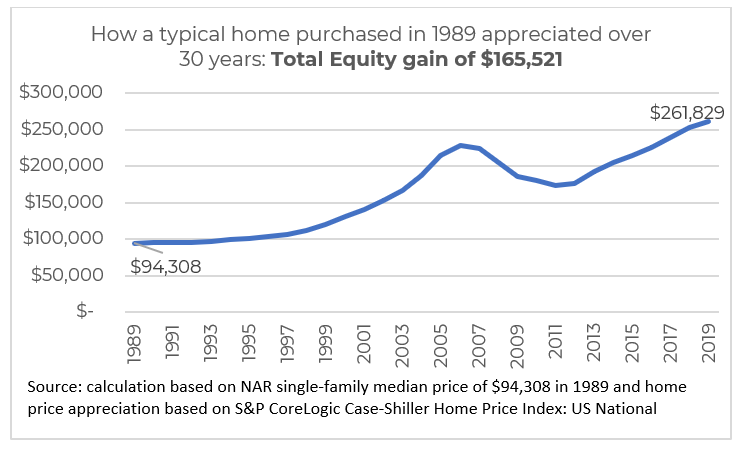

Below, I show the savings from mortgage payment versus rent in a low mortgage environment (~$178,000) and the price appreciation gains from owning a home over the past 30 years (~$168,000). It is no wonder that homeownership is a pathway to wealth accumulation.

Savings from lower mortgage payment over 30 years: $177,500

In June, the 30-year fixed-rate mortgage averaged 3.16%. At this rate, the mortgage payment on a single-family home worth $298,600 (median price) financed with a 20% down payment and a 30-year mortgage is $1,036, which is slightly lower than the median rent of $1,045 in the second quarter of 2020.

Not only is the mortgage payment lower – it will remain so for the next 30 years while rent payment won’t stay the same. If we assume that rent will rise at 2.5% annually, the rent on the 30th year will have doubled to $2,128. The annual difference in mortgage payment and rent starts off at $107 in the first year, but by the 5th year, the savings rise to $1,409 per year, and then to $3,228 on the 10th year, and to $13,328 on the last year. The fact that mortgage rents are fixed while rent rises are one of the causes of the wealth built from homeownership, not counting the equity gain from homeownership.

Typical home equity (appreciation gains) in past 30 years: $167,521

In addition to savings from a lower mortgage payment compared to renting, there is the gain from home price appreciation. Prices fell during the Great Recession but recovered strongly since 2012. Since 1989 through 2019, home prices have appreciated nationally by 77% based on the S&P Core Logic Case Shiller Home Price Index.3 So, if one bought a home in 1989 at $94,308, that home will be worth $261,829 in 2019, or an equity gain of $165,521.

Mortgage rates are expected to remain low for at least a year or two as the Federal Reserve Board keeps rates low to get the economy growing and bring back lost jobs, with nearly 18 million people still out of work. This means that home buying demand is likely to remain strong, with demand coming from first-time buyers, especially millennials who are in their home-buying years. For this to be sustainable, housing starts need to rise again to around 1.5 million, the rate of housing formation. Housing starts fell below 1 million after the economic lockdown delayed permitting and certification.

1 NAR’s 2019 Profile of Home Buyers and Sellers reported that the annual share of first-time buyers was 33%.

2 Social distancing regulations have been concentrated in wholesale/retail trade, hospitality/leisure & transportation ( 40% of unemployed workers) and they have a lower homeownership rate compared to the overall homeownership rate).

3 This is a repeat price index so the appreciation captures changes in sale prices of houses sold with similar physical characteristics.

Scholastica (Gay) Cororaton

Research Economist

Scholastica Gay Cororaton is the Research Economist for the National Association of REALTORS®.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link