Keeping You In The Know-Freehold Township

Another Step Forward for openings-Freehold Township Recycling Drop-off Resumes….Freehold Township will resume normal hours at the drop-off center, located at 66 Jackson Mills Road, this week. Proof of residency needed only.

For addtional information, go to….Freehold Township Recycling

Not a Freehold Township resident? Visit the Monmouth County Reclamation Center (main entrance) located at 6000 Asbury Avenue (west of Shafto Road), Tinton Falls, NJ 07724.

EDGE Scholarship Applications-Open Until 4/3/2020

Who Has the EDGE?…Now it is our time to give back! I am happy and proud to be part of SOMETHING BIGGER and a company that cares about giving back to our communities. Do you know of a NJ College Bound Senior who can use some extra $ toward college tuition?? Having a daughter attening college , I understand the value of opportunities offered. What a great way to begin their college career. Have questions or would like for me to mail you an application…just contact me at 732-995-5609/ NJHomesbyRoslyn.com

Edgescholarship.com

Keeping You In The Know

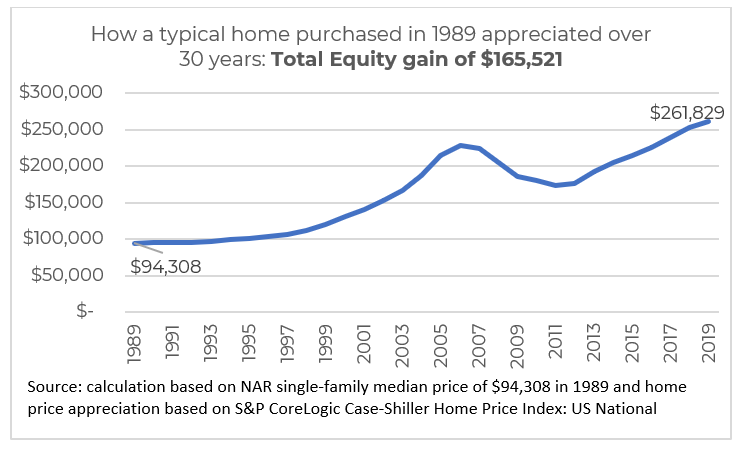

How Did Your County Measure Up with Home Sales?… Let me keep you on current with periodic updates about the housing market in your area. You can reach me at 732-995-5609 / NJHomesbyRoslyn.com. I am always happy to keep you in the know.

Happy Veterans Day

Thanking All Who Have Served…We are grateful for YOU-preserving our Freedom in this Great Country. We Thank you Today and Always!

It’s Summer & Time To Go

Why wait? Moving Season is All Year!…Some try to wait for the perfect time, however you can be putting off your biggest decision indefinitely. Should I move in Spring? Is it better in Summer? Buyers are out all times of the year. There are different advantages at different times when planning a move. Some move because of an unexpected job reloction…wanting to have all in place for September…wanting to be in their new home before the holidays…or simply because they found the house of their dreams without searching. So why wait? Your home can be that next perfect home for them. So take advantage of the current season and some of its advantages and let’s find your next perfect home too! Have questions about what is right for you…just contact me at 732-995-5609 / NJhomesbyRoslyn.com and we can set a plan in place!

–

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link